Definitive Healthcare’s S-1 Breakdown

Definitive Healthcare plans to join a busy year of health tech IPOs as it looks to raise $350M in an IPO this week.

So what does Definitive do? It’s a vertical ZoomInfo, a sales intelligence tool with specific data for health companies to target the right provider customers. It’s also a healthcare data company that competes with IQVIA and directly or indirectly with a host of high-valued private companies like Komodo, Datavant, HealthVerity, H1, Aetion, AllStripes and others that continue to raise large amounts of money.

CEO Jason Krantz started Definitive in 2011 with the mission of making “the complex healthcare ecosystem easier to analyze, navigate and sell into.” Krantz had previously founded Infinata, a SaaS company that helped biotechs research, analyze and develop their drug pipelines. It was acquired by the Financial Times Group in 2007.

Definitive offers subscriptions to a detailed dataset of healthcare providers throughout the US. With Definitive, companies no longer need to Google around to find decision-makers or rely exclusively on the Rolodexes of their sales teams. Definitive obtains this data through a combination of cold-calling, scraping, cleaning and structuring data from public sources (similar to ZoomInfo) and then linking it with other healthcare data sources (claims, pharmacy etc.). Definitive provides a SaaS platform that allows customers to query this data and prioritize their commercial activities.

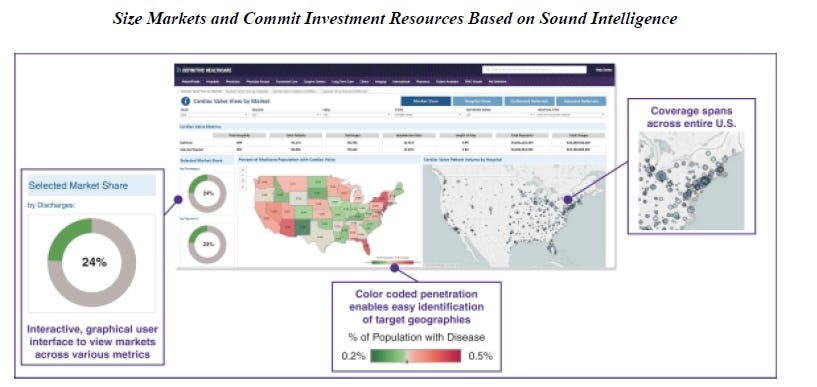

Definitive’s main customers include life sciences and healthcare IT companies (70% of combined revenue) who sell their products to specific doctor segments. These companies use Definitive to size markets, build their go-to-market strategies, track product efficacy, recruit Key Opinion Leaders and develop targeted marketing campaigns based on the types of patients doctors treat and their referral patterns. For example, a medical device company selling a device for a specific knee surgery may want to know the doctors that perform the most of those procedures and the contact information of the decision-maker at those facilities. Interestingly, 24% of Definitive’s revenue comes from customers who sell into healthcare but are not directly in the space themselves. This includes commercial real estate firms, staffing firms, financial institutions and waste management companies who use this data to inform their market sizing or expansion strategy. The final 7% comes from provider systems who use Definitive for recruiting and network management, including analyzing referral patterns to determine upstream relationships they should proactively target.

Definitive did $118M in revenue in 2020, up 37% from $86M in 2019. Its $77M in revenue for the first half of 2021 is up 41% from the same period last year. Definitive has maintained an adjusted gross margin of ~90% over the last two years. The business has an impressive 40% LTM EBITDA margin, putting the business among the best health tech names on a rule-of-40-basis.

As Definitive goes public, the primary financial debates will likely be: Will the company be able to continue its mid-30’s growth rate by expanding further into its existing customer base and selling beyond the largest pharmaceutical, medical device and Health IT companies? And given the recent contraction in EBITDA margin, where will long-term margins settle out?

What is Definitive’s Core Product?

Mapping the interconnectedness of the healthcare ecosystem is complex. Doctors can practice at a hospital, a group practice and their own practice, all of which have different affiliations. Understanding the specific types of patients doctors see and their referral patterns is difficult. Definitive provides a full picture of physician affiliations and referrals alongside a deep profile of the types of patients the doctors treat. They layer on additional data points like the number of beds a hospital has and the RFPs it is issuing.

Parts of Definitive’s product resembles ZoomInfo from key decision-maker contact information to its CRM integrations. But Definitive’s healthcare-specific data allows it to build modules that help its customers show their health system executive prospects the Return on Investment of their solution given that system’s specific patient population and the specific type of doctors to target to reach certain patient populations.

Here are a few screenshots from the S-1 that illustrate Definitive’s various capabilities:

So how does Definitive get this data? Similar to ZoomInfo, some of this effort is brute force. The Definitive team conducts 650,000 calls and 3.7M e-mails a year to verify executive contact information and the type of technology facilities are using. They also structure information from over 250,000 unstructured public sources including 20,000 federal, state and local government databases, journals, publications and job postings. Definitive has also more recently moved into linking this provider data with healthcare claims data. Claims data, which is what a provider submits to a payer to get reimbursed, has information on the procedures doctors undertake, diagnoses of their patients and referring physicians. Definitive obtains Medicare data from the Center for Medicare and Medicaid Services (CMS)and buys commercial data from third-party vendors, likely clearinghouses which sit in between providers and insurance companies. They have 17 billion claims covering over 250 million patients.

Definitive then links this data and runs its own analytics on top of it to determine doctor cost/quality, patient leakage, network analytics, buyer intent and other topics of interest for its customers. The output is exposed in its SaaS solution or a customer’s CRM. Seventy percent of Definitive’s customers use its integrations with their CRM.

Definitive has continued to enhance the depth of its datasets and use cases it can serve through acquisitions. In 2020, it bought Monocl, a company that specializes in helping identify Key Opinion Leaders. Life sciences companies partner with these doctors to advise, promote and lend credibility to the development of products in a certain therapeutic area. In 2019, Definitive bought HSE to improve its identification of patient clusters that could benefit from a product and HIMSS Analytics for additional provider data. In 2016 Definitive bought Billian’s HealthDATA and in 2015 US Lifeline for supply chain data.

Definitive has a variety of data module subscriptions it sells with per user licenses.

Competitive Landscape

Definitive competes against general sales and marketing tools like ZoomInfo. Definitive has a clear value proposition for companies that only sell to healthcare companies given their further linked data sources. But ZoomInfo is a strong fit for companies where healthcare is only one vertical they sell into, especially given its lower price-point. LinkedIn and Dun & Bradstreet also compete in this space.

Definitive also competes against healthcare consulting firms who can do point-in-time analyses. While these consultants may be able to ensure a higher quality go-to-market analysis, it is often cost prohibitive to update their analyses on a more frequent basis.

Definitive’s biggest competitors come from within healthcare, and IQVIA is likely top of the list. It has a consulting services arm to interpret and package findings from its data and can run clinical trials for life sciences companies. This enables IQVIA to provide a fuller set of end-to-end services — though they do this at a higher price-point. Other more established competitors include Clarivate and Symphony (owned by Contract Research Organization ICON) while startup competitors include Komodo Health and H1. Other competitors mentioned by the company include Marketware, Trella Health and Trilliant Health.

These companies differentiate on the data sources they have access to and how easy they make answering questions for their end users. Provider customer data has traditionally been a smaller area of focus for these players than claims data. Definitive seems to be one of the few manually gathering provider customer data though both Komodo and H1 gather data around providers’ research interests and publications for various life sciences use cases. But many data companies have access to claims data. And while most companies can access CMS claims data and buy data from clearinghouses, some companies like IQVIA have exclusive data sources, particularly in the pharmacy space, that make their data more valuable for life sciences companies. Other companies focus on making this data easier to use and analyze for specific questions or teams within their customers.

Financials

Definitive has strong financials which imply it should trade higher than the current expected IPO price-range. Its high gross margins and EBITDA margins are particularly impressive.

Definitive raised an undisclosed sum from Spectrum Equity in 2015 when the business had less than $10m ARR. In 2019, Advent invested in Definitive at $1.7B. The company’s financials are below:

Revenue, Growth, & Retention

Definitive grew 38% from CY’19 to CY’20 and 41% from 1H’20 to 1H’21. Almost all of Definitive’s recent growth has come from account expansion, not new customers. Of the 41%, approximately 37% was attributable to net expansion with existing customers and 4% to new customers inclusive of those acquired through the acquisition of Monocl in October 2020.

Reflective of this expansion in customer accounts, average ACV has continued to increase from ~$42,752 in the year ending 2019 to ~$59,044 in LTM June 2021. Definitive breaks down “enterprise” customers that generate >$100,000 ARR. Definitive has grown the enterprise segment from 221 customers in the year ending 2019 to 349 customers as of June 30, 2021 as many customers likely graduate into this tier. The ACV of the enterprise segment has expanded, resulting in net dollar retention of 125% for the LTM period. Customers of > $17,500 ARR have 111% net dollar retention for the LTM period — implying weaker retention in small and medium sized customers.

No customer represents > 2% of revenue, illustrating the strong customer diversification at Definitive. Two percent of current ARR is ~$3M, likely the largest contract at Definitive today.

On an ARR basis (last quarter * 4 as the business is 99% subscription revenue with over 61% in multi-year contracts), Definitive ended the June 2021 quarter at $159M of ARR. Following the Advent transaction, Definitive has been consistent in averaging ~$11M of net new ARR per quarter.

Margins

Definitive demonstrates strong adjusted gross margins of ~90% with limited variance. The primary costs flowing through cost of revenue include support & operations of the SaaS platform (data & infrastructure costs), professional services costs, and customer support & data research.

The EBITDA margin on an absolute basis has been exceptional at >35% in all previous quarters dating back to 2019. However, EBITDA margin has fallen from high 40% to mid-to-high 30% in the past three quarters.

This is because operating expenses have been increasing as a percentage of revenue with sales & marketing growing 61% y/y, product development growing 63% y/y, and general & administrative growing 98% y/y for the 6 months ending June 30, 2021 while revenue only grew 41%.

Over the short-term, EBITDA margin is likely to stay consistent or decrease, per management guidance in the S-1.

Despite the contracting EBITDA margins, the business is very strong by the “rule of 40”. With an organic growth rate in the high 30% range, as well as an EBITDA margin in the high 30% range, the business exceeds the 40% threshold by a wide margin.

Sales & Marketing

Definitive reports over 10x LTV/CAC. The S-1 does not include a breakdown of sales & marketing by quarter or exact details on new customers, which make meaningful calculations around LTV, CAC, and sales efficiency challenging.

Balance Sheet, Cash Flow, & Acquisitions

Definitive’s cash balance as of June 30, 2021 was $38.4M. The uses of proceeds of the $350M IPO include completing the Up-C transaction (Definitive’s complex organizational structure and this corporate restructuring are beyond the scope of the analysis) and partially repaying borrowings on the Senior Credit Facilities.

The business has about $460M of term loan outstanding following the indebtedness from the Advent acquisition — representing ~8.4x debt/LTM EBITDA. Despite the debt load, Definitive generated $21.9M of cash flow from operations in the first 6 months of 2021 and $23.2M of cash flow in the year ended 2020. Given the growth of the company, the IPO proceeds, and the reduced debt load & corresponding interest expense, Definitive will have significant access to cash.

One historic use of cash at Definitive has been tuck-in acquisitions including Moncol, HSE and HIMSS Analytics. The access to cash helps Definitive compete for acquisitions against well-capitalized players such as IQVIA, Symphony, Komodo, and others.

What Will Determine Definitive’s Success?

The biggest question for Definitive seems to be the size of the market opportunity in front of it. The overall healthcare analytics market is massive. BIS Research says it’s been growing at 22% since 2017 and will reach $69B in 2025. Definitive believes it has a $10B opportunity applying its existing average ARR to a list of potential customers it has, only 3% of which they’ve addressed. Their back of the envelope math is 100,000 companies at $100K ACV. Yet Definitive has already sold 9 of the top 10 pharmaceutical, medical device and Healthcare IT companies. Presumably the largest companies looking to target specific providers or health systems have bought the product. Recent growth has been driven by account expansion, not new logos. Definitive’s new products may help them capture new customers. But this may prove difficult with their focus on products from claims data as they enter quite a competitive market.

Another big unanswered question on Definitive’s prospects is the opportunity for account expansion. As a sales intelligence tool, it’s not simple to increase license counts: managers, not individual reps, often use the tool and if the data already flows into a CRM there can be little incentive for more licenses. But 78% of Definitive’s customers subscribe to fewer than four of their 13 modules which implies a strong ability to continue upselling clients. Natural areas for further module expansion include international provider data.

The bull case for Definitive is they’re able to continue building new modules to expand accounts that certainly have large budgets for this type of data while unlocking new customer types. The bear case is that they’ve already sold through a large portion of the customers who need this data and may find they’re entering increasingly competitive markets with new modules.

Valuation

Definitive more closely matches enterprise SaaS financial profiles than the health tech universe, which is a mix of tech-enabled services and some pure tech businesses. Below, Definitive’s revenue growth, gross margin profile, and EBITDA margin profile are mapped against the health tech space (limited concordance) and a small selection of enterprise SaaS names. The growth & margin profile looks very similar to Veeva and ZoomInfo, which could help bound the valuation given the similar end market (Veeva) and overlapping product (ZoomInfo).

Versus the Health Tech Space

Versus More Similar Companies

Using Veeva and ZoomInfo as the central points of valuation, and carrying forward the historic revenue growth, the valuation range centers around ~$5b. The current IPO range is much lower at $21–24 per share, implying a market cap of $3.1-$3.5B.

Lessons For Healthcare Data Companies

Definitive’s success has interesting implications for healthcare data businesses.

Definitive’s ability to resell a dataset where updates are required frequently is part of what makes it a strong business. Definitive, like many healthcare data companies, has to do a lot of manual work to turn raw, unstructured data into clear output for its customers. They also have to pay third parties for data. But what allows Definitive to keep its ~90% adjusted gross margins is the fact that its customers want similar things from the data. This is not always true in healthcare data as end customers often want very unique analyses or therapeutic areas explored. Furthermore, 99% of Definitive’s revenue comes from subscriptions. In some areas of healthcare data, the data doesn’t meaningfully change from year to year. If you have 2020 data, you’re not going to learn much more from 2021 data, which makes it hard for healthcare data providers to sell subscriptions vs one-off projects. But given how often providers switch affiliations, executives switch jobs and the types of procedures and drugs physicians use changes, it’s essential for Definitive’s customers that they have the most recent set of data.

Definitive has been able to sell beyond life sciences companies. Today, most healthcare data companies monetize from life sciences companies. This makes sense as life sciences companies have expensive, high margin products and thus a high willingness to pay for products that can increase sales. But life sciences revenue is only 48% of Definitive’s sales. Other companies selling into healthcare clearly want tools to more effectively segment customers, build their ROI story and increase sales efficiency. Healthcare data companies that can serve these segments have a massive opportunity to increase their Total Addressable Market.

Another part of what makes Definitive and other healthcare data businesses attractive is account expansion through selling further modules. As the healthcare analytics market grows 22% annually it seems many new use cases are being enabled across end customers. Definitive offers 13 modules and has been able to reach 125% Net Revenue Retention for its enterprise customers. Many of its modules have been enabled through acquisitions. A consolidation of companies in the space makes tremendous sense given similar go-to-markets and winners in the space will likely offer a similar amount of modules beyond their initial wedge.

Definitive has clearly built an impressive business. A big congratulations to the team on the IPO milestone! It will be interesting to see how consolidation and competition continues to play out in the healthcare data space going forward.